Breaking Down OnlyFans’ Stunning Economics

Though a private company, Fenix International (“OnlyFans”) is a UK company and therefore required to publicly disclose certain information pertaining to its business and operations. And while these disclosures are limited and end at 30 November 2023, they reveal enough about the OnlyFan’s revenues, profits, scale, defensibility, reach, and impact to say that it is probably the most successful UK company founded since DeepMind in 2010, and the most significant media platform founded since TikTok (via Musical.ly in 2014), and dedicated creator economy platform… ever

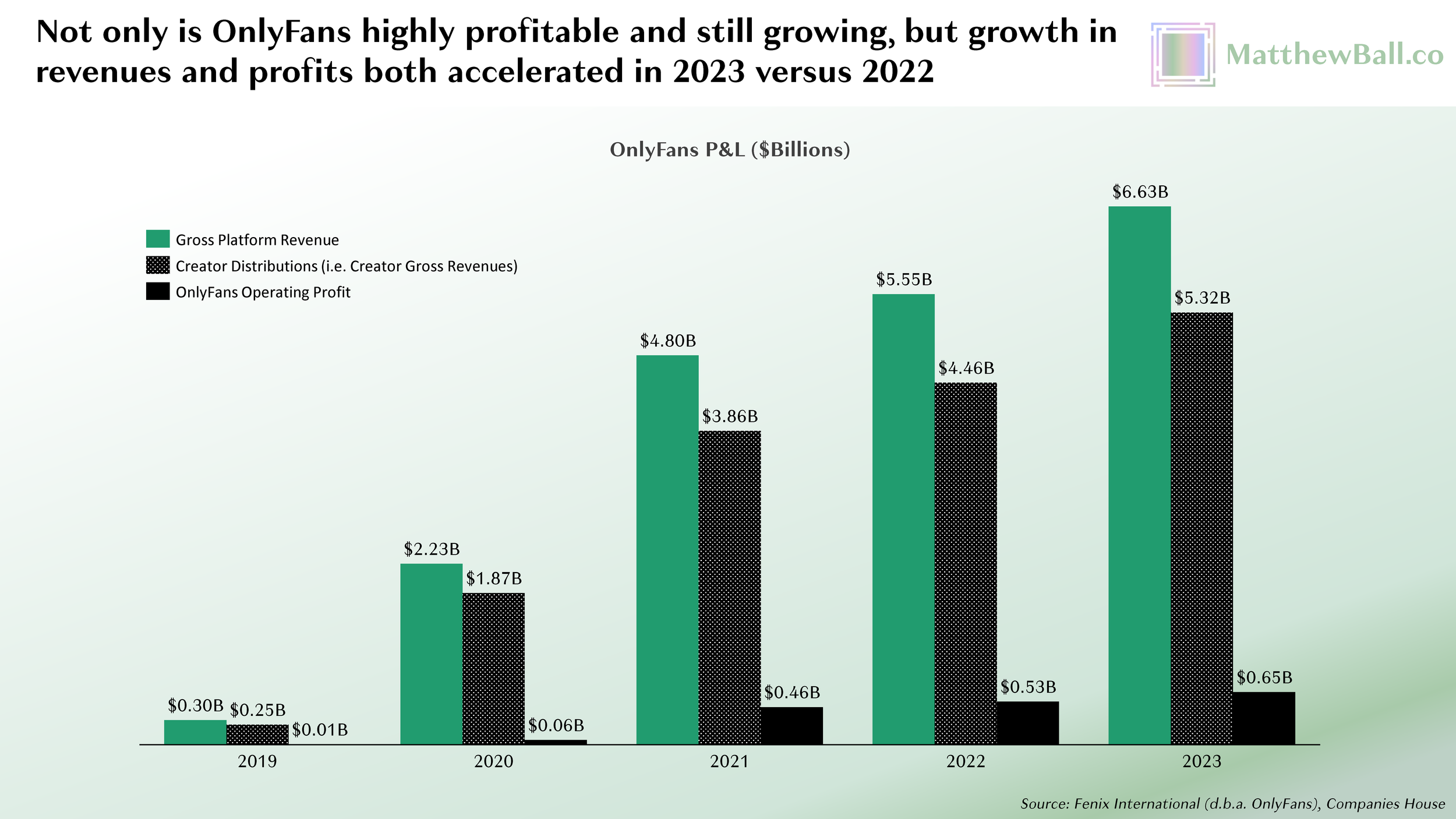

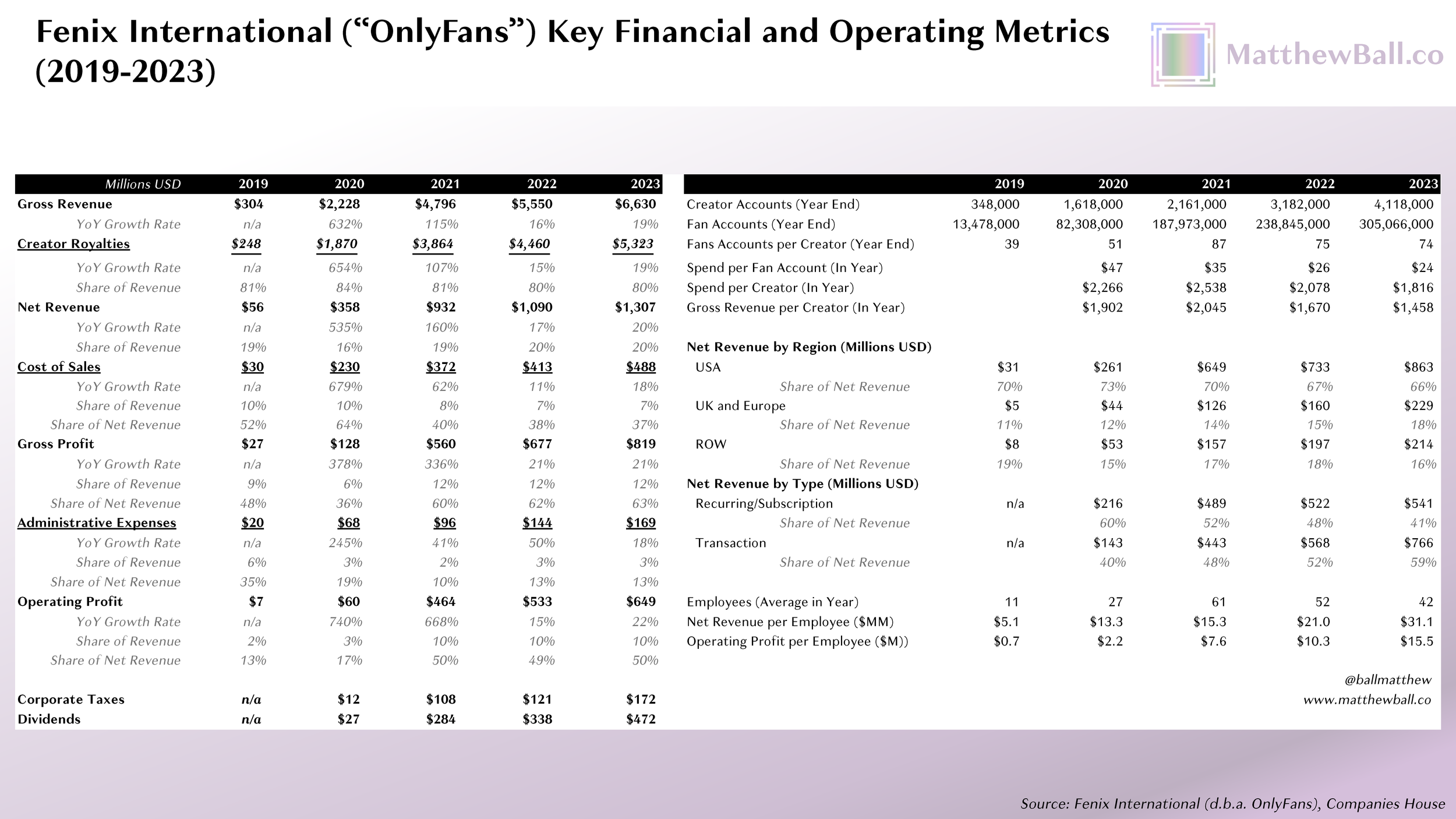

In 2024, OnlyFans generated $6.3 billion in gross revenues, up from $300 million five years earlier. Though the company is unlikely to ever match its pandemic growth rates given its current scale, revenues in FY 2023 grew 19% (or $1.1 billion) year-over-year, three percentage points greater than 2022 (which grew $754 million). Though OnlyFans is based around subscriptions, over 60% over consumer spending is now via transactions (and unlike say, Candy Crush, these are not micro transactions but instead add-on purchases that can cost dozens of dollars or more). Indeed, subscription revenues are up only 9% since 2021 (or $227 million) whereas transactional spending is up 70% (or $1.6 billion), representing 88% of total growth. OnlyFans revenues are now believed to be twice that of pornography giant Aylo (formerly known as MindGeek), which owns PornHub, Brazzers, RedTube, YouPorn, and XTube, and the platform counts over 300MM registered users (not all of whom pay or are active, but no such disclosures have been made). Two thirds of revenues are from users in the United States and, while the UK plus Europe is another 16%, with the remaining 17% “Rest of World.”

Revenue growth is propelled by growing brand awareness (including the genericization of "OnlyFans" to mean intimate creator subscription), the addition of high profile creators such as Cardi B, Bella Thorne, Denise Richards, Carmen Electa, Larsa Pippen, Tyga, DJ Khaled and Fat Joe (some of whom do not offer any pornographic content), regulatory action that has (quite rightly) forcing many X-Rated market leaders to delete the majority of their catalogues (much of which was uploaded without any compliances processes whatsoever) and undertake laborious know-you-customer processes for new uploads and uploader accounts, and the decisions of social media networks such as Reddit and Tumblr to ban (or de facto ban) pornography, which created an addition market vacuum while also compelling creators with large followings to actively redirect their fans to an alternative. More broadly, many OnlyFans creators now treat sites such as Reddit, Imgur, Instagram, TikTok, and Twitter as “front doors” for OnlyFans customer acquisition. In most analogous cases, platforms rebel against creators who try to redirect their audiences (or their spend) to rival services – or at least try to launch an integrated feature/offering that might displace an alternative. However, none of these sites compete with OnlyFans directly (what’s more, they usually ban pornography), and thus they typically allow this behavior as long as it complies with their terms of service and is not too overt. Moreover, these platforms tend to benefit from the investment of OnlyFans creators as it results in (often highly viral) content that they don’t need to pay, explicitly encourage, or involve themselves with.

Another reason for OnlyFans success is its high revenue share rate – 80% – which far exceeds that which a creator might get as a performer working for a production company or other agency. In totality, OnlyFans is slowly consuming the entire porn industry because creators and pornstars alike can make more money, in a safer way, while having greater autonomy and offering audiences experiences that feel more authentic, differentiated, and valuable.

[As an aside: OnlyFans 80% revenue share rate is practical only because it does not offer App Store-based billing (which would take 15-30% of revenue off the top). In fact, neither iOS App Store nor Google’s Play Store even allow for pornographic apps. Usually, such a ban would destroy a media platforms’ business model, but browser-based experiences are fine for viewing photos and videos and sending messages (in contrast, most games can’t even run). And while apps tend to offer better user experiences and far simpler payment processes, most OnlyFans customers aren’t dissuaded by the need to use a browser, nor the extra hoops involved in manually entering a credit card number (again, this is less true for casual games or ecommerce).]

Over the past five years, OnlyFans creators have collected over $15 billion – with $5.3 billion paid in 2023, a 19% increase year-over-year. As a point of comparison, total NBA salaries during the 2023-2024 season was $4.9B, Premier League payroll was just under $5.3, and the cap for the NFL was $7.2 billion. Of course, these leagues count 500-1,700 players each whereas OnlyFans has some 4.1 million creators. However, OnlyFans is an open platform (any legal adult with a bank account can become a creator) whereas these leagues include only the very best players of a vastly larger system of developmental, semi-professional, collegiate, and hobbyist leagues. And as tends to be the case with UGC platforms, OnlyFans earnings are highly concentrated among top creators who collect the vast majority of revenues while most creators take home very little (just as the payrolls for athletes who aren’t in the “marquee” leagues are modest-to-non-existent).

YouTube, the biggest video platform in human history (and the highest grossing, too), distributed more than $10 billion to creators last year – twice as much as OnlyFans, though the platform’s revenues are 4.5x as high (YouTube’s revenue share rate is only 55% and not all revenues qualify for revenue sharing, nor do all YouTubers, with YouTube shorts sharing only 45% not 55%; the result is a roughly 30% effective estimated rate). MrBeast, YouTube's most popular creator, “does a couple million in [YouTube] ad revenue” for each of the 15-20 videos he posts on his main channel (he posts some 100 other videos on his other channels, which generate substantially fewer views). In 2024, he is expected to gross $80-100 million in YouTube creator payouts – a sum that doubtlessly eclipses the combined revenue of most of YouTube’s other 114 million active channels, and which makes the “average” YouTuber take home (let alone average uploader to YouTube) irrelevant by comparison.

Mathematically, the average OnlyFans creator grosses roughly $1,800 annually (of which $1,450 nets to the creator). But according to data previously displayed on OnlyFans’ internal creator dashboards, creators in the top 0.1% collect 15x as much as the average creator in the top 1%, and 100x that of those in the top 10%. The multiple versus those in the rest of the distribution was not shared but is likely to be in thousands and tens of thousands. According to one 2020 research report cited by the Washington Post last year, the top 10% of accounts collected to 73% of revenues (which would have been 365,000 and $3.9 billion in payouts last year, or $11,000 each), while the the top 1% were 33% (or 36,500 collecting $1.8 billion, or $49,000 each). Under such a distribution, the top 0.1% would hold 15% (3,650, $800 million, and $220,000 each), and top 0.01% would be 6.8% (365, $361 million, $1 million). OnlyFans does not disclose its distribution, and it should be noted the two distributions above are not consistent, but a handful of creators proved that they make upwards of ten million per year – and these creators are not even the highest earning ones!

Pictured Below: Screenshots released by the creator Bhad Bhabie on Instagram Stories showing her OnlyFans’ dashboard during her first year on the platform (2021), as well as running totals in April 2022 and July 2024. These reports, which have not been independently verified, show her lifetime gross billings exceed $70 million, with Bhabie collecting $57 million. Over half of revenues were generated via paid messages with individual users (which may include custom audio-visual content).

As the distribution of revenues are unequal, so too are fans. There are over 305 million registered fan accounts (not all of whom are “active,” let alone paid subscribers), which works out to 74 fans per creator, but the top creator accounts have tens of thousands to millions of fans.

A common technique among top creators is a series of tiers, including a free tier, that become increasingly expensive (e.g. Basic: Free, Standard: $5/month, Premium: $10/month, VIP: $100/month) and where additional transactions (e.g. pay-per-view messages or images) not only require additional transactions, but are only available to subscribers in the top tier in the first place. To minimize churn, many benefits (e.g. back catalogues) are only available to long-running subscribers. Top subscriptions also receive the ability to directly communicate with the creator (which enables these users to make requests that might lead to further upcharges). In many cases, the responses are actually written by a member of the creator’s extended team – remember, many of these creators are now multi-million dollar enterprises, and its obviously impossible for creators such as Bhad Bhabie to engage in detailed and personalized conversations with their scores of VIP subscribers – though this alleged subterfuge has resulted in some legal action. In this sense, we should recognize that many fans are paying for parasocial relationships and fantasies of connection, rather than just photos and video. Many of the top accounts are not X-Rated and some focus altogether on the sort of content one might expect from Patreon or Substack, rather than OnlyFans, or are otherwise just pay-gated access to a private (but PG-13 rated) Instagram with additional features and upsells.

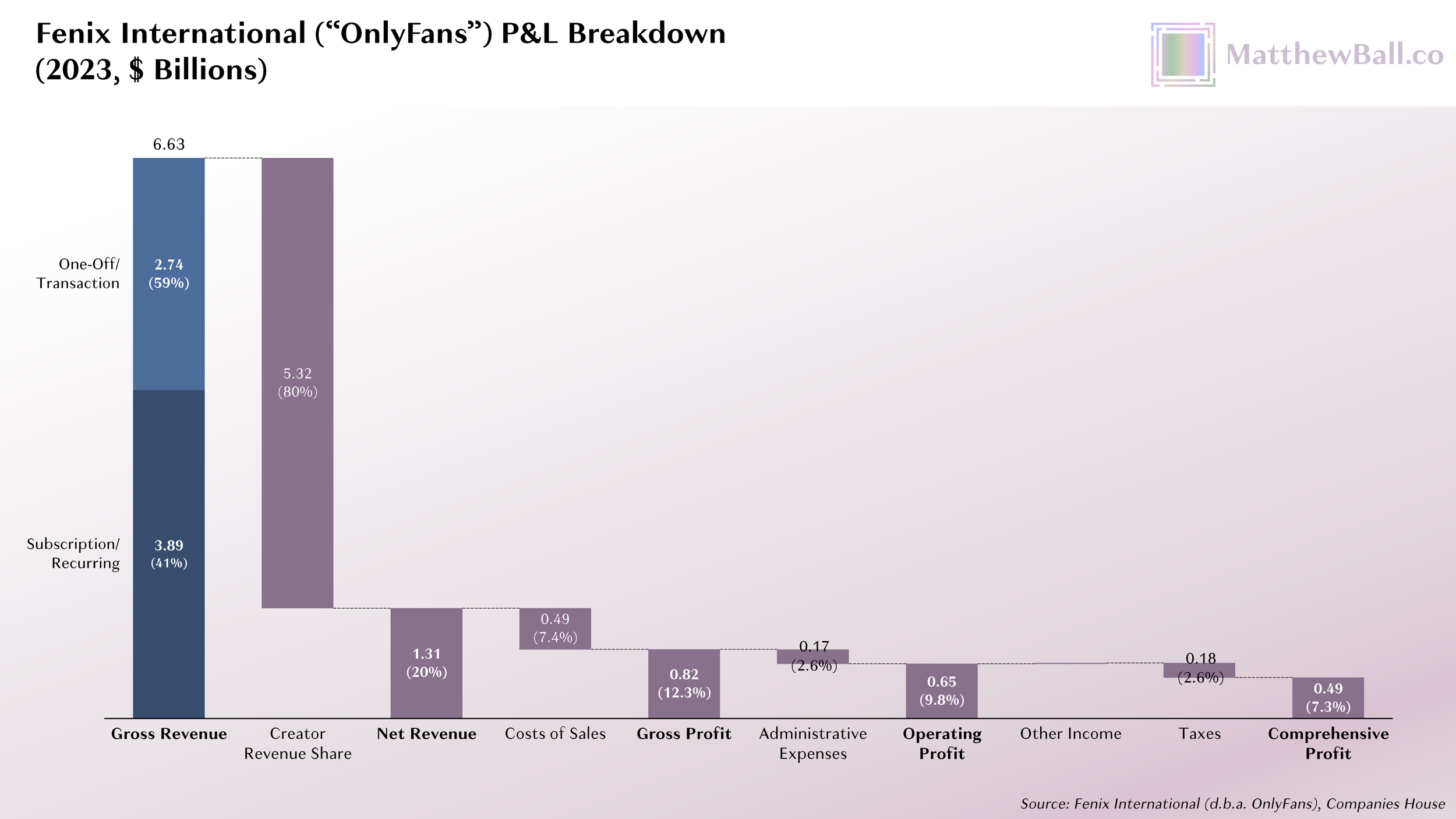

Though 80% of gross revenues are relayed to creators, OnlyFans generates considerable profits. In 2023, the platform had net revenues of $1.3 billion and gross profits of $819 million (at least half of the $488 million in sales costs would be for credit card processing fees, with much of the rest relating to bandwidth, servers, etc.). After all overhead, operating profit was $649 million (50% of net revenue and 10% of gross revenues), with the last five years totaling $1.74 billion ($400 million was then paid in taxes).

The company counted an average of only 42 employees in 2023, down from 61 two years earlier. During the year, it generated $31MM in net revenue per employee (13-28x that of Amazon, Apple, Google, and Microsoft) and $15.5MM in operating profit (27-560x). OnlyFans’ operations also supported by hundreds of contractors.

OnlyFans has paid its two owners $1.1 billion in dividends since 2019, with $472 million paid in 2023 alone. Remarkably, Leonid Radvinsky, who had previously founded a pornographic livestream company, bought 75% of OnlyFans in 2018, at which point profits had (likely) not yet passed one million on a cumulative basis.

For several years, a number of direct competitors to OnlyFans have emerged, some of whom offer greater revenue sharing with creators, too. Yet, OnlyFans two-sided marketplace scale (i.e. with users and creators) has proven durable, not just lucrative.

There are, however, two interesting questions beyond “How much bigger can OnlyFans become?” First, will (the appropriately renamed) X be successful in attacking the category and how will it affect OnlyFans? In June 2024, Elon Musk ended the platform’s ban on pornography in June of 2024 – a move that came not long after it launched paid subscriptions and gated messaging. Second, how might Generative AI, inclusive not just of images and videos, but also personified and personalized agents, affect the category?

[The videos below are non-pornographic; the essay continues afterwards]

It’s just as easy to imagine demand for the “real thing” going down due to the emergence of more substitutes as it is to imagine the premium for parasocial authenticity going up. Yet only Generative AI “creators” will truly do whatever “you” want and only for you. Unlike real ones, they speak in every language and are available at any time, too (and will eventually support in immersive 3D). And given that many of the messages sent by the top creators are actually written by support staff, almost assuredly repurpose “custom” content, and may already be using to LLMs, some fans might even consider truly bespoke Generative AI creators to be more authentic, not less.

Matthew Ball (@ballmatthew)